Difference between revisions of "Note Payable"

Tao alexis (talk | contribs) |

Tao alexis (talk | contribs) |

||

| Line 16: | Line 16: | ||

== Banking == | == Banking == | ||

| − | + | The introduction of banking institutions represents an evolution towards a more formalized and sophisticated economic system. The presence of bank "branches" gives the role of notes payable an enhanced significance, extending beyond the localized trust-based exchanges. While in village settings, notes might function as IOUs between known entities, at the inter-city level, they transform into formal instruments to request or transfer large sums of money. | |

| + | |||

| + | Such exchanges between major cities, especially where influential banking houses operate, necessitate a heightened level of security and authenticity for these notes. Given the larger sums and distances involved, the risk associated with fraudulent or counterfeit notes increases. As a result, these notes are meticulously crafted, often integrating intricate designs to deter forgery. | ||

| + | |||

| + | Moreover, in a world where magical interventions are possible, banking institutions might employ enchantments or magical seals to further safeguard these notes. These protective measures not only deter potential tampering but could also enable tracking or verification mechanisms. | ||

| + | |||

| + | For a farmer or carter in a village, presenting such a magically-protected note from a recognized bank could bolster their credibility and ease transactions, even with those they might not personally know. On the other hand, for the banks, such notes represent a way to facilitate and regulate large-scale trade and monetary exchanges across cities, offering a blend of traditional trust-based barter practices with more formalized banking mechanisms. | ||

Revision as of 18:26, 20 October 2023

Notes payable are legal instruments that allow individuals in a barter economy to make formal agreements surrounding payments to be made in the future, either at a set date or upon the payee's request, based on predefined conditions. When someone entrusts goods to another party, and repayment is necessary, the party responsible for repayment can issue a "promissary" note. This effectively functions as a private currency, representing the full value of the deposited goods and promising their eventual settlement.

In a designated local, commonly a hamlet or village, the payee introduces the note to a creditor before a predetermined date. Within regions operating on a bartering system, especially in a developed hex that lacks a coin symbol, personal acquaintance among all three parties — the payer, payee, and creditor — is essential. A payer won't commit to a note for an unknown entity, and similarly, the creditor won't recognize a note without familiarity with both involved parties.

Challenges of a Barter Economy

In the absence of a standardized currency or a centralized banking system, trust plays a pivotal role in a barter economy. As seen in the scenario, personal acquaintance and trust among all parties involved are prerequisites for transactions. This reliance on personal relationships often limits the scope and scale of trading, making expansive trade networks challenging.

The introduction of a "creditor" and the use of notes suggest an emergent credit system. This is an advanced concept within a barter economy, allowing for time-delayed exchanges and potentially enabling more complex transactions than simple direct trades.

Transactions therefore take on more personalized and trust-based dimensions. For instance, when a farmer delivers produce to a garner or a carter post, the typical mediums of exchange, like coins, might be absent. The facility or transporter might not possess the necessary currency to compensate the farmer directly. Moreover, for the farmer, carrying coins back home, storing them, and then taking them to a local market can be cumbersome and risky.

Instead, in such situations, the farmer opts for a note — a tangible promise of due compensation. Upon reaching the village market, this note can be redeemed, allowing the farmer to acquire the desired goods or services without the direct exchange of physical currency. This system streamlines transactions and mitigates the hazards associated with transporting money.

In a parallel scenario, a carter might engage with a garner to move goods. Rather than a direct exchange of commodities or coins, the carter issues a note to the garner, who can then redeem it in the village market in a similar fashion as the farmer.

Banking

The introduction of banking institutions represents an evolution towards a more formalized and sophisticated economic system. The presence of bank "branches" gives the role of notes payable an enhanced significance, extending beyond the localized trust-based exchanges. While in village settings, notes might function as IOUs between known entities, at the inter-city level, they transform into formal instruments to request or transfer large sums of money.

Such exchanges between major cities, especially where influential banking houses operate, necessitate a heightened level of security and authenticity for these notes. Given the larger sums and distances involved, the risk associated with fraudulent or counterfeit notes increases. As a result, these notes are meticulously crafted, often integrating intricate designs to deter forgery.

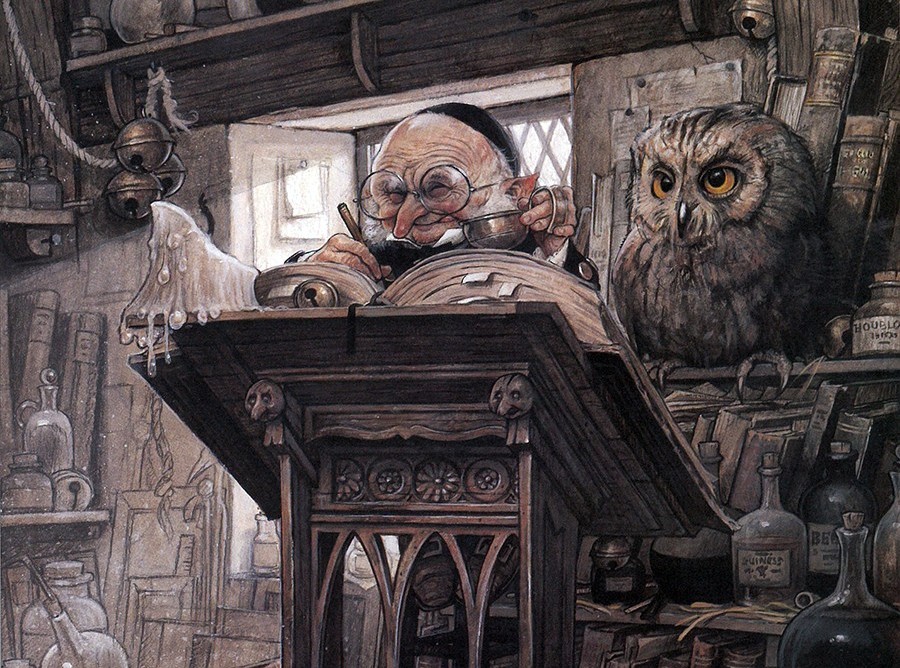

Moreover, in a world where magical interventions are possible, banking institutions might employ enchantments or magical seals to further safeguard these notes. These protective measures not only deter potential tampering but could also enable tracking or verification mechanisms.

For a farmer or carter in a village, presenting such a magically-protected note from a recognized bank could bolster their credibility and ease transactions, even with those they might not personally know. On the other hand, for the banks, such notes represent a way to facilitate and regulate large-scale trade and monetary exchanges across cities, offering a blend of traditional trust-based barter practices with more formalized banking mechanisms.

See also,

Coin (symbol)

Debt